History for the music industry repeats itself first as arrogant tragedy, second as arrogant farce. Investment banking and financial services group Goldman Sachs recently published its latest Music In The Air report on the economic health and future of the music business. It is precisely the kind of thing one might expect from an investment banking and financial services group: it goes heavy on praising the plump numbers while roaring that there is plenty more money coming. It’s like a TED Talk from Gordon Gekko in a biker jacket.

It looks at the global recorded music, music publishing and live music on a macro level. In aggregate, of course, the numbers are fantastic and Goldman Sachs is even saying that it is raising its forecasts as everything is going so swimmingly. And what’s this? We are apparently entering “a new era of improved music monetisation” as it expects streaming subscription numbers to rise, streaming subscription prices to rise and the full arrival of what it calls “super premium plans catering to superfans” (more of which below, but basically it means finding more ways to fleece music’s best customers).

This comes after the publication of steadily rising global record industry numbers in 2023 (as gathered by the IFPI), up 10.3% from 2022. There was almost identical growth in the UK last year (as per the BPI’s numbers), but there was slightly lower growth in the US (as per the RIAA’s numbers), although an 8% increase in the world’s biggest recorded music market is still a lot of money.

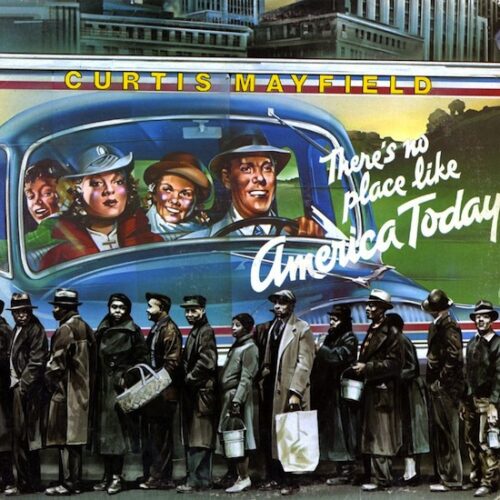

After steady declines from 2000 to 2014, it was to be expected the record business would trumpet any signs of growth. But almost a decade after revenues started to inch upwards again, this triumphant bellowing is curdling into a corrosive bluster. One would have thought that the record business facing down the biggest existential crisis of its existence would have made it (even a little) more humble. That humility did not last and is being replaced by a new age of arrogance.

These growth numbers now stand like the monolith in 2001: A Space Odyssey – blankly triumphant, cold, immoveable. “We are the greatest!” roar the giants of the record business. “Our genius cannot be stopped. Sunlit uplands only.” The bottom line for the major labels is fantastic. But speak to the 10% of staff being laid off at Warner Music recently (the majority at Uproxx, HipHopDX and social media publisher IMGN, but also at the music company proper) and they might not agree “a rising tide lifts all boats” (a phrase record company executives love to repeat).

A similar lack of jubilation may grip the “hundreds” being laid off (sorry, experiencing a “headcount reduction”) at Universal Music Group, conformably the biggest of the three majors, as part of a “redesign” (never has a word done so much heavy lifting) to save the company €250 million a year. A few months later, it was revealed that Lucian Grainge, Universal’s chairman and CEO, was getting a €139 million payout (including a €92 million share-based bonus). One presumes the newly unemployed staff would not begrudge him that as he did, after all, have to experience a 51% cut in his annual salary which is now a paltry €7.5 million.

There is a yawning disconnect in the business. Companies themselves are doing fantastically well. And yet staff numbers are being pared back and many artists themselves, unless they are in the Taylor Swiftian top 1%, say that a proper living from recorded music income or songwriting royalties is a cruel pipe dream. Spotify recently published its latest Loud & Clear report showing just how much artists can earn from it. It says 1,250 acts generate $1 million or more from it a year, up from 460 in 2017. (These numbers should be approached gingerly as label cuts, management commission and tax will have to be deducted.) Further down the pecking order, 11,600 acts generated $100,000 or more on Spotify in 2023 (up from 4,300 in 2017). And 66,000 (up from 23,400 in 2017) made $10,000 or more.

This is just their Spotify income. The streaming business suggests if we multiply that by four we get a truer picture of their overall income from recorded music. Yet looking at those figures and then dividing that four or five ways if it is a band, one is left with the harrowing feeling that this is not the victory Spotify likes to think it is.

On the live side of things, there is plenty of talk about – tickets for Taylor Swift’s Eras tour are going like proverbial shit off the equally proverbial shovel. But if you are playing shows a lot further down the touring pecking order, things are far from great where acts paid £5,000 to play a festival might, after costs and deductions, turn a profit of £277.60. Even the smaller venues are imploding and festivals are being cancelled as the long-promised post-Covid bounce back is something only the biggest acts are benefitting from.

A report like Music In The Air is, in its defence, not there to drill down into every level of the music business and show the reality (as beautiful or as harsh as it might be) for all of them. It is just about the topline numbers. But these big numbers are a trompe-l’œil. It sends out a message to the public and to the music business that, when you look at the amalgamated balance sheet, everything is absolutely fantastic. It is jam today, jam tomorrow, jam forever.

Ultimately the report means another round of hot arrogance being served up for the bold “captains of industry” of the music business as they gorge themselves into a coma at the Pomposity Trough.

Greed only begets more greed. An incrementally bloated and stretched belly needs more and more to fill it when feeding time comes around again. So the industry is turning to even more ways to squeeze cash out of its most loyal customers. It is calling them “superfans” now, but the more cynical might suggest “stooges”, “marks” or “patsies” are more apposite names. Charge them more for their subscriptions and charge them extra for access to “exclusive content”. Build “superfan apps” for them. Make even more “vinyl variants” for their next album and suggest to fans that they are not real fans unless they buy them all.

All of this feels utterly reckless and far too focused on a short-term injection of cash without contemplating the long-term risks of screwing over/shaking down your best consumers.

I recently published a book about 1999 being a break year in the record business. The 1990s were all about growth and scale and expansion, fuelled by the miracle format of the CD bringing utterly unprecedented levels of money into the record business and ossifying a belief that it was unstoppable and that more and bigger profits each year were its birthright. The cliff edge was looming, but far too many people were far too drunk on their own importance to notice it or even care.

It was quite the experiment to spend a couple of years “living” in 1999, all the while knowing what the ending was. The warning signs of an impending disaster were all there if you were self-critical enough to spot them. And now, in 2024, with the same sense of arrogance and entitlement gripping the industry, I cannot help but feel like Cassandra.

Reports like the Goldman Sachs one are giving the industry even greater licence to be even more arrogant at the exact moment they should be discouraged from being so. Pride come before a fall. A re-run of 1999 is brewing. Music In The Air is not the Kool-Aid the music business should be asking for second and third helpings of.